Banking Professional Certification Agency (LSPP) is a certification agency licensed by the National Professional Certification (BNSP) founded by professional association and banking industry association.

LSPP History

LSPP was founded according to notary deed no. 07 on 26th of October 2006 by Notary public Arie Suminar Wulandari SH and decision of the Minister of Law and Human Rights Republic of Indonesia no. C.95.HT.01.03 year 2007 on 19 December 2017 supported by several associations. According to the notary deed, the purpose of LSPP suits the statue paragraph 3: attribute, goal and purpose, paragraph 2: the goal and purpose of LSSP is:

- Providing an institution to give license for banking professionals, including constructing what related to it but not limited to it.

- Improving the role of high integrated, professional, and caring of national development banker.

- Supporting banking industry which adheres to the principle of prudence and compliance with regulations for the sake of maintaining the image of Indonesian banks.

- Ensuring the certificate for professional banker to keep the competence which is acceptable by Indonesian people.

To prepare the certification for banking competence, LSPP together with the related association conducting competence mapping of banking industry . from the investigation gained 13 competence fields of banking industry, those are internal audit, information banking, general banking, risk management, treasury dealer, human resource, funding and services, legal and compliance, sales and marketing, wealth management, lending, finance and accounting, and operation. Certification planning will be done for 9 of them; Internal audit, General banking, Risk management, Treasury dealer, Human resources, Funding and services, Legal and Compliance, Wealth management, Lending, and operation.

The first competence test done by LSPP is on 16th of September 2008 according to the license of LSPP based on the decision of BNSP through SK No. KEP 16/BNSP/VI/2008, 19th June 2012. According to the license, the first competence test is for internal audit and followed by Treasury dealer in the same year. In 2008, it was prepared for gaining the license for the Wealth management but it was not fulfilled because of some particular reasons.

In the following year, LSPP was ready for the certification for Risk Management field and proposed the license to BNSP since January 2009. LSPP included a recommendation letter from BI in the form of letter No.105/LSPP/III/2009 on 3rd of March 2009 and BI gave the recommendation on 5th of April 2010, in accordance with the letter of BI No.12/213/DPNP/IDPnP. It took long time to gain the license for the risk management field. The license was gained on September 7th 2011 in accordance with the SK BNSP-LSP-030 ID and KEP-116/BNSP/IX/2011. Hopefully the license for the Risk Management field will improve in the future.

Legal and License

LSPP stands on the willingness and support of banker in Indonesia. Besides, the presence of LSPP is supporting the fourth pillar of Indonesian Banking Architecture (API), to create a strong and competitive banking industry which resistant of risk. Work competency standards are needed in order to create equality and increase the professionalism of bankers.

Certificate of work competency in Indonesia is regulated by BNSP, an independent agency formed according to PP No.23 2004 to regulate work competency in Indonesia. This is an application of the statue No.13 2003 of labor. In this term, as the regulator, BNSP gives the certificate for profession certification agency which fulfilled the requirements.

Work competency certification of banking industry in Indonesia was developed and done by the professional banking certification agency (LSP) with the license from BSNP as SK No. KEP 16/BNSP/VI2008, June 19th 2008.

Afterwards, BSNP using SK No BNSP-LSP-030 ID; and KEP-116/BNSP/IX/2011, spread the licence to enlarge the area which includes:

- Internal audit

- Treasury Dealer, Settlement, and Money Broker

- Wealth Management

- Risk Management

The licence was given because LSPP has fulfilled the requirement set by BNSP; founded and supported by profession association and industrial association. Those are IBI and association of industry: Perbanas, Himbara, Asbanda, asbisindo, and Perbarindo.

Vision and Mission

Vision

To be strategic partner of banking industry in producing international standard professional banker in Indonesia.

Misi

- Ensuring the construction of newer and international standard work competency standard of banking.

- Setting the system and method of certification which suit the need of industrial banking.

- Certifying independent and high quality banker.

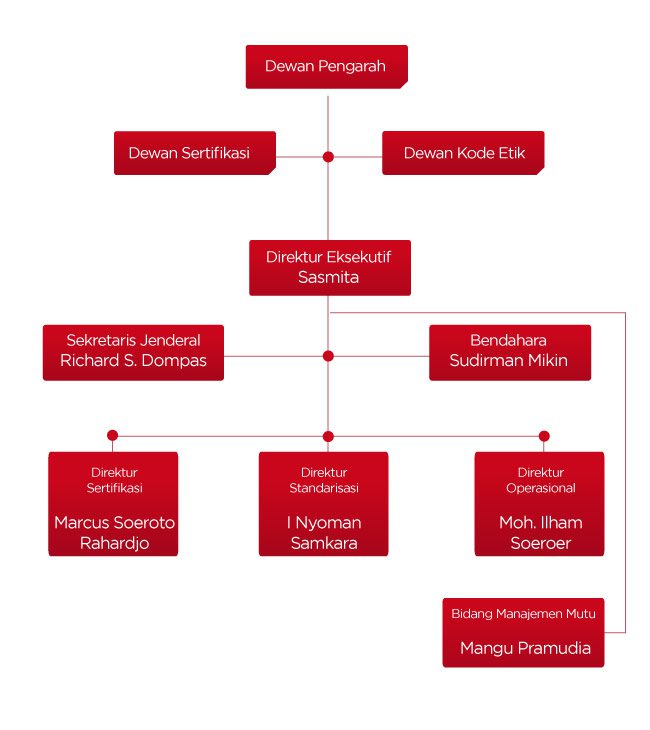

Organization and Administrator

Advisory Council

Zulkifli Zaini : General Chairman of IBI

Sigit Pramono : General Chairman of Perbanas

Gatot M Suwondo : General Chairman of Himbara

Eko Budiwiyono : General Chairman of Asbanda

Yuslam Fauzi : General Chairman of Asbisindo

Joko Suryanto : General Chairman of Perbarindo

Code of Conduct Council

Eko Budi Wiyono : General Chairman II IBI

Ogi Prastomiyono : Head of Organization, Membership, and Advocacy Department of IBI

Irwan M. Habsjha : Head of Research, Assessment, and Publication Department of IBI

Certification Council

Herwidayatmo : Head of Coaching and Professional Development IBI

Sentot A. Sentausa : General Chairman of BARA

Darmadi Sutanto : General Chairman of CWMA

Hidayat Prabowo : General Chairman of IAIB

Panji Irawan : General Chairman of ACI Ferexindo

Daily Administrator

Sasmita : Executive Director

Richard s. Dompas : General Secretary

Sudirman Mikin : General Accounting

Marcus S. Raharjo : Certification Director

I Nyoman Samkara : Standardization Director

Moh. Ilham Soeroer : Operational Director