According to the statue no. 13 of Labor, mentioned that recognition of the competence of the work done through labor competency certification. Work competency is the ability to work based on knowledge, skill, and attitude relevant to the task and requirements of term of office.

According o President of Indonesia regulation no. 8 2012 of Indonesian National Qualifications Framework, work competency certification is a systematic and objective certification process through test of competence appropriate to the national Standard work competency of Indonesia (SKKNI), International standard, and/ Special standard.

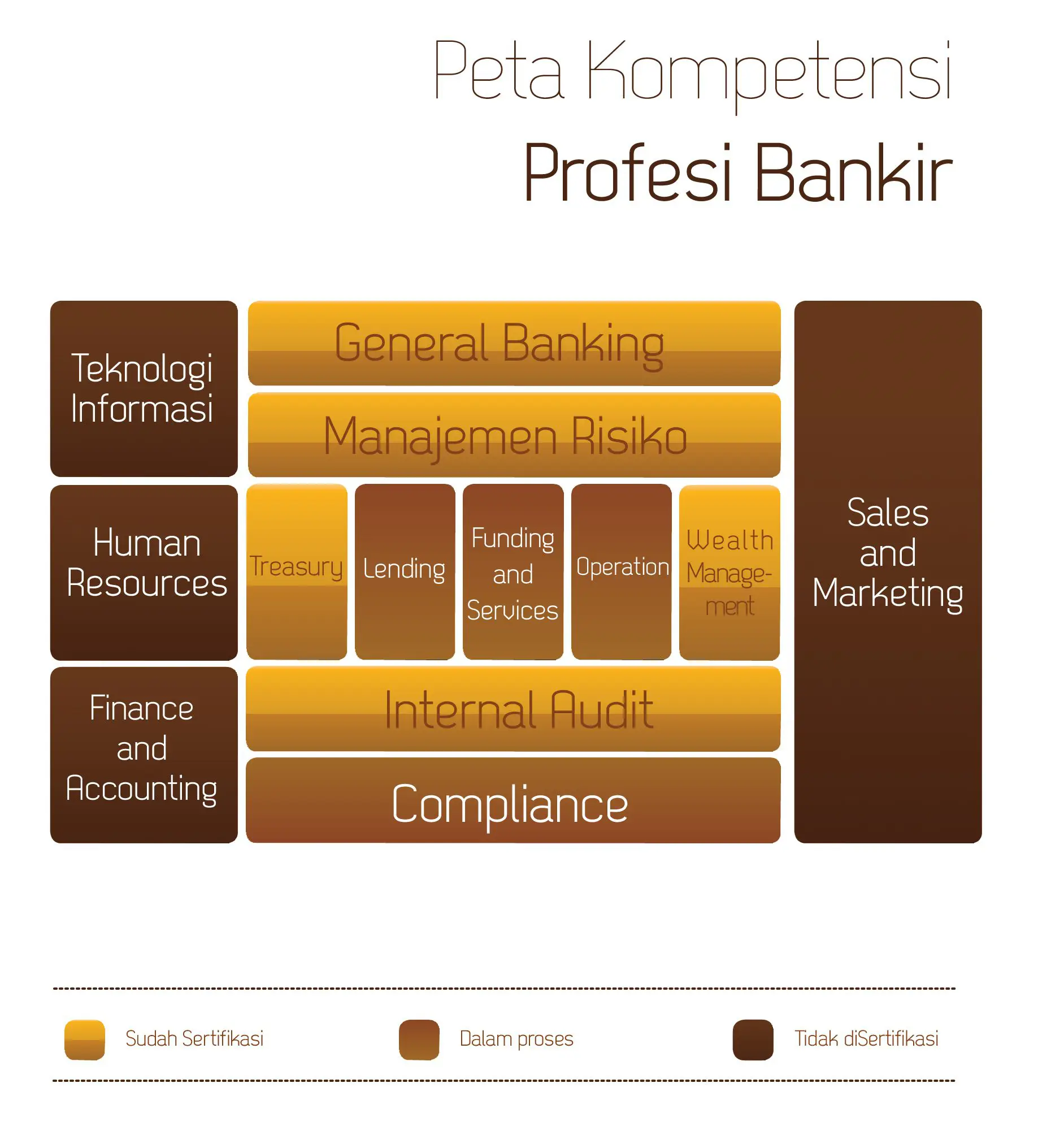

Up to now, the Institute of Indonesian Banker (IBI) as the only one association of banker profession in Indonesia identified 12 competencies in the industry of banking; risk management, internal audit, compliance, treasury, wealth management, lending, funding and services, operation, sales and marketing, human resources, finance and information technology. Besides, there is a general banking competency needed by the level leadership, which includes general banking and syariah banking.

- Founded by he association of banker (IBI), association of industry: Pebanas, Himbara, Asbanda, Abisindo, Perbarindo.

- Supported by Association of profession BARa (Banker Association for Risk Management), IAIB (Ikatan Audit Internal Bank), ACI (Association Cambiste Internationale Indonesia) Forexindo, CWMA (Certified Wealth Management Association).

- Recommended by Bank of Indonesia according to the letter of BI No.13/66/DPNP on 14 Februari 2011.

- Licensed by BNSP according to the decree No.KEP-117/BNSP/IX/2011 on 7 September 2011.

Based on the regulation of BI No. 11/ 19 /PBI/2009 on 4 June 2009 about risk management certification for administrators and general bank officer and regulation of BI 12/ 7 /PBI/2010 date 19 April 2010 about the change of the regulation of BI No. 11/19/PBI/2009 about risk management certification for administrator and general bank officers, the bank have to place the administrator and bank officers by competence people mastering risk management. The administrator and officers should have the certification of risk management given by professional certification agency.

The right certification for you is the certificate that suits your job and position.

As long as the banker works in the same field, the competence should be maintained. According to the guideline of BNSP as the regulator of professional certification, instead of certifying it is also maintain professional competence.

Based on the regulation of BI, the administrator and officers who are certified should join the refreshment program at least once in 4 years for level 1 and 2, also once in two years for the level 3, 4, and 5. The rules of refreshment program of risk management certification are written in sole (click here to download) ===> the rules and requirements in email.

While the term of the maintenance program for other areas of competence specified in the certification scheme approved by the Scheme Committee consisting of professional associations, among others, according to the field.

BANKING PROFESSIONAL CERTIFICATION AGENCY (“LSPP”)

The registration can be done collectively (through company/ bank) or individually.

and shall be submitted directly to to LSPP office

[tg_button href=”#” align=”center”]REGISTER[/tg_button]